Is the Australian economy outperforming your business?

What is in store for the Australian Economy – is a recession looming? What does this mean for businesses?

With the Covid lockdowns and the government stimulus coming to an end, there has been a flurry of consumer and business activity within the Australian Economy.

On the world stage, a significant downturn in production during the pandemic, which continues to occur to this day with various parts of China being thrust into lockdown, a legacy remains being the worldwide lack of supply of product. This has resulted in both the delay of products for businesses to sell, and in certain sectors such as the construction industry, an increase in product prices of up to 30%.

In recent times, we have also seen a drastic price hike in cost of living expenses ie food, transport, etc. Together with the low unemployment rate, soaring house prices, it is no wonder that, according to the Australian Bureau of Statistics (ABS), the Consumer Price Index (CPI) rose 2.1 percent this quarter, and 5.1 percent over a twelve month period (to March 2022)

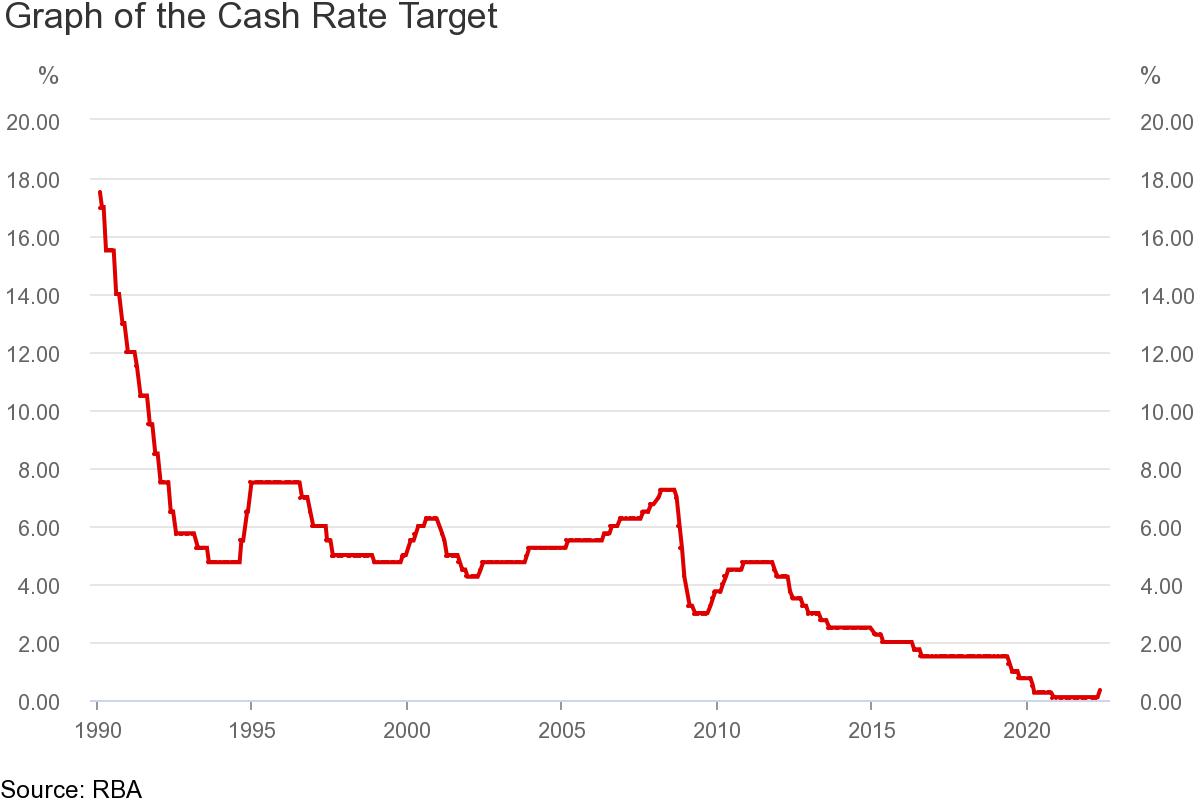

In an effort to curb inflation, on 3 May 2022 the Reserve Bank of Australia (RBA) announced in increase in the cash rate target to 0.35 percent (from 0.10 percent). Just hours after the announcement, major banks across Australia have increased their mortgage rates, passing the full cost on to consumers in line with the RBA’s decision.

It is important to consider the impact of the above on small businesses. Has, and will, small businesses be able to cover the additional cost of doing business? And the greater question; What is in store for the Australian Economy – is a recession looming?

There are a number of factors weighing on the answer to this question. There are the obvious global events causing instability and domestic determinants, such as the upcoming federal election and domestic labour shortages. So how does this all relate to small businesses and their ability to weather through the disruption (current and future)?

According to the Australian Taxation Office (ATO) small businesses make up 97.7% of business in Australia[1]. With this as a consideration, we can contextually conclude that disruptive factors imposed on small businesses can cause major economic volatility on a domestic grand scale (such as a recession). In a prophetic term of “future proves past”, it is important to briefly reflect on trends to identify if in fact interest rates and inflation hikes do have recessive consequences.

Back to the Future

The last known mass scale ‘downturn’ was the Global Financial Crisis (GFC). The RBA stated that the GFC commenced from early 2007 through to early 2009. In the lead up to the GFC, as illustrated in the RBA graph, the dormant period of rate stability in 2005 led to a series of interest rate hikes followed by the GFC. In 2005, the interest rate remained stable for 13 months (2005) at 5.5 percent. The interest rate increase that followed (at 5.75 percent) would be the first of 6 major rate increases, with the highest point of interest at 7.25 percent in August 2008. Importantly, (and alarmingly), both RBA statements from May 2022 and March 2005 (at the increase of 5.75 percent) had shared similar sentiment. Some of these similarities were steady to strong GDP growth, increasing “inflationary pressure” and higher commodity pricing. On the 3rd of May, 2022, the RBA stated that “The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead.” A key noting factor is the intention to continue further interest rates in the immediate future.

Similarly, in August 2006, the RBA further increased interest rates to 6.0 percent with the same justification stating “inflation pressures have increased.” In November 2006 (just prior to the GFC) the RBA also stated the justification for interest rates increasing to 6.25 percent was that “inflationary pressures had increased”.

Whilst the GFC was “Global”, we can identify that prior to the GFC period, similar domestic factors are noted at present. Acknowledging the recent (and continuing) pandemic global disruption, we now need to determine our current state of play and how this impacts small businesses from an insolvency perspective. Whilst it is directly stated that the RBA will further increase interest rates, what we do not know is how many increases will occur.

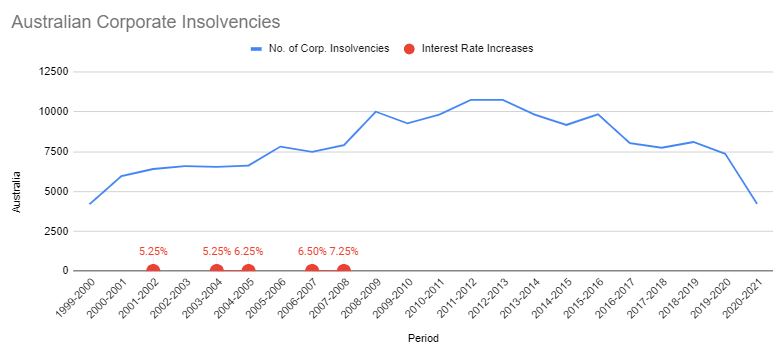

From 2006 year on year, corporate insolvencies rose from 7,487 to 7,907 to a staggering 10,005 (in 2008/9). The Australian Securities Investments Commission’s (ASIC) corporate insolvency statistics indicate the relation between interest rate increases to increases in corporate insolvency.

A Retrospective Look: The 1990s “the recession we had to have”

The contentious quote by Labour Treasurer Paul Keating, became one of the most well known events in Australia’s financial history. Although over 30 years ago now, we look at similarities today that signify trends. In 1987 the international stock markets crashed, interest rates were increasing (globally) and domestically, Australian businesses were failing under the pressures of high loan interest rates and unmanageable debt. A significant decrease in asset prices caused the inability to repay loans and ultimately reverting back to the banks.

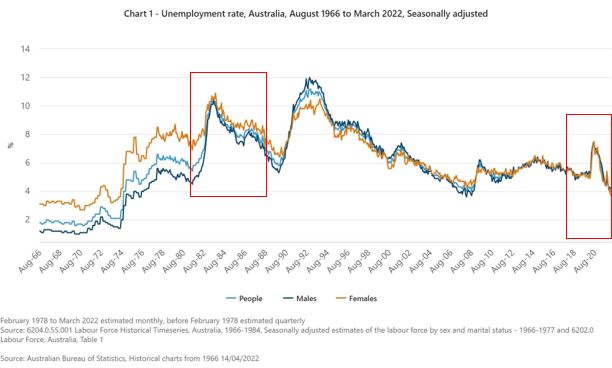

“The recession started in the September quarter of 1990 and lasted until the September quarter of 1991. During the recession, GDP fell by 1.7 per cent, employment by 3.4 percent and the unemployment rate rose to 10.8 percent. Like all recessions, it was a period of disruption and economic distress.” Former Reserve Bank Governor, Ian Macfarlane.

It was also important to note that during this time the United States had suffered their own major financial crisis, a factor that impacted Australia’s recession. Not dissimilar to today’s financial global state.

Typically, a ‘recession’ according to the RBA, is a “sustained period of weak or negative growth in real GDP (output) that is accompanied by a significant rise in the unemployment rate.” The RBA also indicates that businesses during a recession are unable to repay loans in addition to a decrease of business investment and labour shortages.

As unemployment has been known as a key indicator of a recession (Ref: RBA), the graph below indicates a historic unemployment rate trend from 1966 to current. [2]

If we isolate the upturn peaks in the years prior to the 1990’s recession and the period from 2018/9, we can illustrate some similarities. In the following section, current employment shortages are further noted with their impact on businesses. While there is no certainty of predicting future outcomes, we can draw similarities on how the past can help decipher probable events.

Current Factors Impacting Small Business Performance and Profitability

Although experts declare we are in the ‘endemic’ phase, businesses are still dealing with the effects from the past few years and juggling the weight of current economic instabilities. From local small retailers to large construction companies, each sector faces its own challenges and environmental issues. Some of these factors are summarised as the following:

- Over 57 percent of businesses have reported an increase in operating costs (more than usual)

- 33 percent of businesses consequently negotiated payment terms with suppliers and deferred or cancelled investment plans

- 13 percent of businesses were forced to seek additional funds to cover the increase in business costs

- 18 percent of businesses were understaffed due to national labour shortages and 84 percent of businesses were simply unable to find suitable staff

- 41 percent of businesses were dealing with major supply chain disruptions; 54 percent were in the construction industry

- Significant increase in fuel prices and natural disasters (mainly Queensland and New South Wales floods)[3]

In addition, these supply chain issues were caused by higher costs, international supply shortages, freight challenges and imposed pandemic restrictions. Evidently, construction and building suppliers are currently reporting nationwide timber shortages, soaring labour costs and importing restrictions are creating immense pressures and even financial failures. With these pressures stemming from early 2021, we have seen several large construction and building companies collapse. Notably when a construction company is declared insolvent, the financial loss is felt throughout the entire project supply chain.

During the past two years, the insolvency market has been at record lows. This has mainly been due to the Federal Government’s Covid19 business grants. Businesses had also benefited from the jobkeeper packages, ease of tax lodgment deadlines and relaxed tax debt repayment deadlines. However, with these now completely ceased, businesses are finding it difficult to pay tax debts and secure tax debt payment plans with the ATO. Furthermore, the ATO have expressed recent concerns that business tax debts are mounting and consequently tax debt recovery actions have already commenced.

The current business climate provides little ‘safety net’ for businesses that are financially stressed and had already been in financial distress prior to the pandemic.

A Time to Plan

Whether or not a conclusion can be drawn from the question of a possible near recession, we do know that Australian businesses are dealing with major challenges. These challenges are not only on a domestic level, but extend to a macro-economic level also. This is a common factor of past recessions, and together with the additional the weight from the past two years, there is a real need for business to develop a plan to navigate their way through the economic recovery from the Covid-19 pandemic and effects of same.

We have all heard the famous quote by Benjamin Franklin: “If you fail to plan, you are planning to fail”.

Firstly, it is critical to seek professional advice if your business is suffering from financial distress. The earlier you seek advice, the more options are available for debt resolution. If your business is facing any of the below signs, it is time to speak to an insolvency professional:

- Continuing trading losses

- Tax debt

- Overdue supplier invoices and utility bills

- Unpaid wages and superannuation

- Letters of demand

Noting one of the examples mentioned in this article; if you are a construction company and you foresee, or are suffering, supply shortages causing unmanageable debts and revenue loss, it is vital you act now. Preparing a business survival plan is considerably important for any business in this current operating environment.

Points of consideration:

- What is the impact of changes in conditions on your business?

- Is my business adaptable for market disruptions?

- Are budgeted forecasts up to date? Do I have enough cash to maintain business stability over the next 3, 6, 12 months?

- Have I maintained business financial reporting and do I know what my current financial position is (weighing up total expenses to revenue)?

- What are my stock levels? Do I have overstock/understock? Should I liaise with my suppliers to suit my business (line of stock etc)?

- Does my business have healthy working capital? Do I have enough working capital in ratio to my business debts? Do I have enough liquid assets?

- Do I need to negotiate on my business finance with my financial lenders?

These are some key considerations that are relevant to all businesses whether it is only for a ‘check up’ or when dealing with difficult times ahead.

If you have questions relating to how we can help your business, call our team on 1800 463 328. We are experienced business recovery and debt solution experts.

Article written by Darren Vardy, Insolvency Options, 6 May 2022.

[1] Businesses earning from $1 million to less than $10 million in turnover.

[2] Historical charts from 1966 | Australian Bureau of Statistics (abs.gov.au)

[3] ABS (April 2022) Business Conditions and Sentiments, April 2022 | Australian Bureau of Statistics (abs.gov.au)